Toyota and Lexus Price Hike: A Modest Bump or Strategic Signal?

Will They Stop Subvention and Cut Incentives?

Toyota and Lexus Price Hike: A Modest Bump or Strategic Signal?

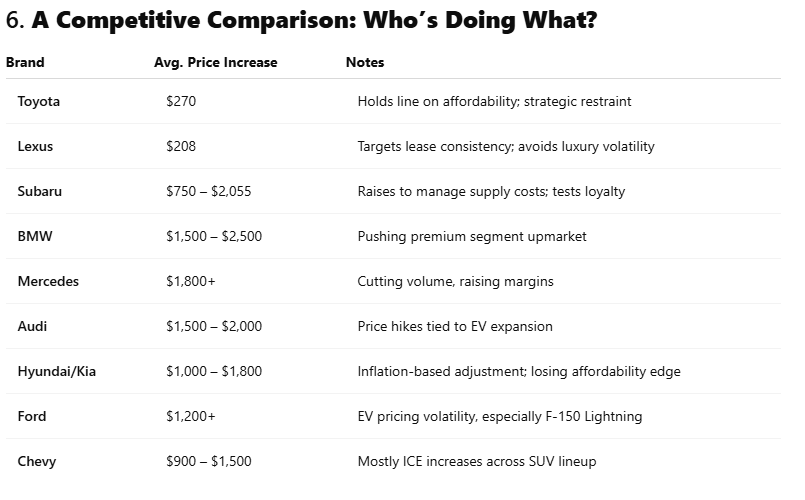

In July, Toyota will raise vehicle prices by an average of $270. Lexus will follow with a more modest increase of $208. At first glance, these numbers appear conservative especially compared to Subaru, which is implementing price hikes between $750 and $2,055 across its lineup. And when most automakers are raising prices by $1,500 to $2,000+, Toyota’s move feels almost symbolic.

So what’s really going on here?

1. A Tactical Move in a Turbulent Market

Toyota's measured increase comes at a moment when many OEMs are struggling to balance affordability with rising production costs. Raw materials, labor, logistics, and compliance costs continue to climb. Brands like BMW, Mercedes, and Audi have all raised prices aggressively often by 4%–7% citing these pressures.

Toyota, by contrast, seems to be playing a long game.

Rather than shock the market with price jumps, they’re signaling resilience and stability particularly to their customer base, which includes budget-conscious and brand-loyal buyers.

2. Will They Stop Subvention and Cut Incentives?

One question hovering over this modest price bump: Will Toyota and Lexus begin pulling back on subvention (interest rate buydowns) and customer incentives?

Historically, Toyota has been generous with rate support especially on Camry, RAV4, and Tacoma. Lexus has used low APR and lease cash to keep monthly payments attractive in the luxury segment.

With this price increase, analysts are watching closely. A shift away from subvention could quietly raise transaction prices without making headlines. It would also align with Toyota’s broader goal of protecting margins without inflating MSRP headlines.

So far, there’s no confirmed pullback but incentive spend has been tightening compared to 2023 levels.

3. Protecting Market Share and Perceived Value

Raising prices modestly protects Toyota and Lexus’ brand equity and retention rates. It prevents sticker shock. It keeps lease payments within reach. And it maintains their status as the smart buy—even when demand for new vehicles is cooling.

It’s a contrast to European competitors. Mercedes-Benz has been repositioning itself upward, aggressively chasing margin over volume. BMW is following suit. Audi has been pricing aggressively on EVs like the Q4 e-tron in response to supply pressure and tax credit eligibility.

Toyota’s approach? Hold the line.

And that restraint may give them an edge as interest rates remain high and affordability continues to deteriorate.

4. G7 Signals and Japan’s Global Leverage

Sources have reported backchannel meetings between Toyota executives and G7 trade officials during recent summits. While the details remain under wraps, multiple analysts suggest Japan is aligning its automakers to emphasize price stability and global competitiveness particularly as EV regulations, tariffs, and protectionist policies evolve.

This could explain why both Toyota and Subaru a rival, but also a strategic partner in Japan are making carefully timed and measured pricing adjustments.

Subaru’s increase is more aggressive, but still moderate compared to U.S. and European peers. These hikes may be an attempt to preserve margins without alienating their core buyers.

5. The EV Wild Card

Toyota’s slow rollout of EVs has been heavily criticized, but they may be quietly repositioning. While most legacy OEMs went all-in on electrification, Toyota hedged investing in hybrids, solid-state battery tech, and diversified platforms.

A modest price hike now could foreshadow a larger strategic shift in Q4 or early 2025, when their EV portfolio begins to scale and pricing power becomes critical.

Final Take: A Harbinger or a Head Fake?

Toyota and Lexus may be signaling more than just a minor cost adjustment. Their restraint hints at:

Confidence in volume-based growth over luxury margins

A hedge against rate volatility and consumer fatigue

Strategic alignment with global trade and production policies

A gradual exit from subvention and incentive dependency

It’s not a bold move. It’s a smart one.

And that might be the most competitive advantage of all in 2025.