The Recon Trap: Why Your Frontline Isn’t Turning and What It’s Costing You

What Great Operators Do Differently

The Recon Trap: Why Your Frontline Isn’t Turning and What It’s Costing You

By the time you read this, you’ve likely got 8 to 12 cars waiting to hit the frontline. Not because they can’t sell but because your recon process is quietly killing your cashflow

.

The 3-Day Myth

Most dealers think they have a “tight recon process.”

“We turn cars in 3 days, 5 max,” the used car manager says.

“Techs handle reconditioning fast we’ve got it dialed,” the service director adds.

“Photos go up right away,” BDC swears.

But when you actually pull the data?

It’s not 3 days. It’s 8, 12, sometimes 19.

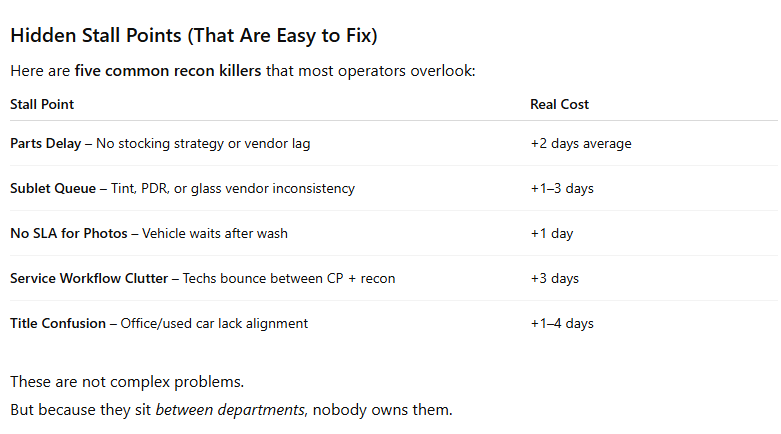

The recon process has silent stall points that almost no operator tracks in real time:

Waiting for parts.

Waiting for sublets.

Waiting for photo sets.

Waiting for someone anyone to say “go.”

You don’t have a recon process.

You have a recon hope.

What It’s Costing You

Here’s what happens when recon drags:

Age builds. Vehicles shift into 30–60–90-day buckets, which means markdowns.

Margin erodes. Every unsold day shaves your front-end by $200–$500 in holding cost or price reductions.

Cash gets stuck. Floorplan interest builds. Titlework stalls. You can’t rotate your investment.

Comp plans crack. Used car managers start chasing paychecks instead of processes. Salespeople get disengaged.

One store we reviewed had:

$3.1M in aged inventory

$1.2M of it tied up in recon purgatory

$19,000 in floorplan expense last month alone from aged units that hadn’t even been photoed

And nobody was accountable.

What “Day 1” Really Means

If you're not measuring Time to First Touch, you’re already behind.

Day 1 = In Your Possession + Tagged + Assigned + Clock Started.

Not “we’ll get to it.”

Not “the tech knows it’s here.”

Not “it’s on the list.”

Every hour that passes without real movement compounds the age problem. The moment a trade or auction unit hits your lot, the meter starts. Your recon process is either protecting your margin or bleeding it out, silently, one delay at a time.

What Great Operators Do Differently

Elite operators don’t “guess” their recon days. They inspect them daily and build process like a pit crew, not a parts queue.

Here’s what they do:

Daily Recon Huddles. Used car + service + photo + sublet updates every morning. 7 minutes max.

Recon SLA Dashboard. Time to first touch, recon complete, photo live—color-coded by age buckets.

Tech Pay Accountability. Flat rate + bonus tied to recon efficiency (if separate from CP).

Clear-to-List Process. As soon as photos are up + descriptions are written, units are “live” even before lot placement.

Weekly Stall Report. Any unit over 5 days in recon flagged and reviewed. With names attached.

Do You Know Your “Recon ROI Line”?

If a car takes 7 extra days to hit the front line and loses $1,200 in price reduction + $140 in floorplan, are you still ahead?

How many of your units are below the line?

This is the kind of financial clarity most stores lack but you don’t have to.

Download This Week’s Tangible Tool

“Recon ROI Calculator + 5-Day Recon Tracker” (Excel + PDF)

Use it to:

Run recon loss models by car

Audit where your stalls are really happening

Identify savings opportunities in parts, photos, or tech efficiency

Before You Blame the Market, Check the Mirror

It’s easy to blame used car softness, high rates, or tough buyers.

But many of your slow units are margin-positive cars that just took too long to reach the buyer.

You didn’t lose the sale.

You lost the window.

Fix recon, and you fix:

Turn

Cashflow

Morale

Profit