While headlines are focused on Trump’s potential “deal” with China to reduce tariffs, the real implications won’t show up in press releases they’ll show up in product strategies, pricing power, and global factory footprints.

Over the past 72 hours, two major trade stories broke:

The U.S. and China are closing in on a tariff rollback framework that could reduce duties on Chinese auto exports from 100–145% down to 50–60%.

The U.K. quietly secured a bilateral agreement with the U.S. to cap auto export tariffs at 10% for up to 100,000 units and eliminate aerospace duties altogether.

Taken separately, they’re political wins.

But taken together, they reveal a new playbook that will shape how global automakers especially luxury OEMs position themselves for the next decade.

This isn’t about avoiding tariffs. It’s about reengineering leverage.

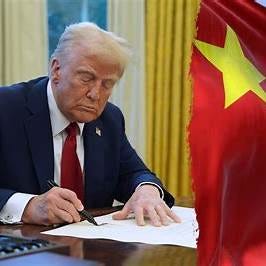

What We Know About the China–U.S. Deal in Progress

Multiple sources confirm that negotiations between U.S. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng are making “substantial progress.”

Expect a deal structured like this:

High tariffs remain on low-cost Chinese EVs (think BYD, NIO, XPeng)

Negotiated reduction for legacy brands and joint ventures with significant U.S. presence (like GM-SAIC)

Export controls on key materials stay in place, particularly rare earths and lithium derivatives

This isn’t a reset. It’s a managed realignment designed to avoid economic escalation—and to keep inflation from ticking up during an election year.

Predicted outcome:

Tariffs on Chinese vehicles and parts will drop, but strategically, not uniformly. Brands with U.S. partnerships and localized assembly get the break. The rest stay boxed out.

Why the U.K. Deal is the Real Signal

The U.K.–U.S. agreement is more than a trade deal. It’s a strategic wedge.

By giving U.K. automakers (Jaguar Land Rover, Mini, Rolls-Royce) a tariff cap while EU automakers remain under full 27.5% duties, Trump has:

Created intra-European pressure

Incentivized OEMs to shift U.S.-bound production to U.K. plants

Undermined the EU’s unified trade front

And the aerospace carve-out? That’s a shot at Germany and France, cloaked as goodwill toward Britain.

The strategic move?

Mercedes, BMW, VW, and even Ferrari may now reconsider U.K. production or partnership strategies for U.S.-bound units—if the tariff differential becomes permanent.

The Luxury OEM Dilemma: Margin vs. Control

No segment is more exposed to trade shocks than luxury.

High sticker prices magnify tariff penalties

Globalized supply chains leave little room for insulation

Customers demand consistency, not geo-dependent product shifts

Here’s what’s likely to happen next:

Mercedes-Benz & BMW

Expect both to lobby EU trade offices for reciprocal deals—or explore relocating limited U.S. volume production to U.K. sites (or even Mexico). Mercedes’ Tuscaloosa plant gives it partial cover. BMW has Spartanburg. But the 85% U.S.-made content rule to unlock tariff offsets will pressure component localization.

Audi, Porsche, Ferrari

These brands are more exposed. Limited U.S. manufacturing, high component import ratios, and luxury pricing make them ideal targets for tariff penalties. Don’t be surprised if:

Audi accelerates a U.S.-EV assembly plan

Porsche leans harder on Macan EV production in Slovakia to serve multiple markets

Ferrari prices shift up dramatically in North America by Q4

Tesla and Polestar

Tesla gains a relative edge from its U.S. manufacturing, but exports to Europe will face future retaliation. Polestar, still dependent on Chinese manufacturing, becomes a tariff casualty unless it ramps up assembly outside of China.

For U.S. Dealers and Retail Operators

This trade realignment is not just an OEM issue.

It will hit your desk in the form of:

Price volatility across luxury and EV SKUs

Lower availability of key trims tied to international production

Changes in incentive structures designed to push U.S.-assembled units

Service pricing pressure as imported parts feel secondary effects

Smart stores will:

Monitor where their OEMs source parts and assemblies

Push for margin support tied to high-tariff units

Train staff early on how to communicate price increases tied to global policy shifts

Where This All Leads: Predictions and Market Consequences

Expect more bilateral deals not global consensus.

The U.K. deal is a test balloon. If it doesn’t trigger EU retaliation, other countries will push for their own carve-outs.Watch for “production diplomacy.”

Brands will use assembly location as leverage in trade discussions. Expect new plants to open in politically favorable zones—not necessarily economically ideal ones.The tariff map will become the new P&L battleground.

CFOs will measure every vehicle program not just by margin, but by geopolitical exposure. Tariff risk modeling will become standard.China’s EV pricing advantage is temporarily capped—but not dead.

If tariffs are reduced, expect a flood of mid-tier EVs looking to undercut Tesla on price. How the U.S. responds will define the next phase of the electric transition.

Final Word: This Isn’t Trade Policy. It’s Global Brand Warfare.

The real question isn’t how much the tariffs are.

It’s who’s willing to play long enough to win under them.

And right now, the most prepared brands aren’t the loudest—they’re the ones already reshaping where, how, and why they build.

This moment won’t be defined by politicians.

It will be defined by who adapts faster: the manufacturers, the supply chains, and the leaders who understand that global strategy now starts with borderlines, not spreadsheets.

Share this post