Part 2: Strategic Shifts Shaping the Automotive Industry in 2025

Leasing as a Key Strategy for Retention

Part 2: Strategic Shifts Shaping the Automotive Industry in 2025

As the U.S. automotive market transitions into 2025, the industry is entering a critical phase defined by transformative strategies, technological advancements, and shifting consumer expectations. Part 1 detailed the challenges and successes of 2024, including sales trends, inventory levels, and economic influences. Now, let’s delve deeper into how automakers, dealerships, and consumers are preparing for what lies ahead.

1. Accelerating the EV Transition: A Double-Edged Sword

The electric vehicle market remains a focal point of innovation and risk. While EV adoption is growing, the road ahead is far from smooth.

Rapid Technology Advancement

Automakers like Ford and General Motors are doubling down on advanced EV platforms, with plans to release models boasting over 400 miles of range by late 2025.

However, technology obsolescence remains a pressing issue. Buyers fear their shiny new EV could lose value quickly as more advanced models emerge. This is already reflected in the 25% year-over-year drop in pre-owned EV prices. (CarEdge)

Global EV Leadership

Abroad, China's BYD and Nio continue to dominate EV production, exporting competitively priced models. These vehicles are expected to enter the U.S. market aggressively, challenging domestic brands. (Reuters)

Europe’s luxury automakers, including BMW and Mercedes-Benz, are experimenting with subscription-based EV features like adaptive driving modes and software upgrades—a trend that may soon expand stateside.

Consumer-Centric Strategies

To combat affordability concerns, Toyota has expanded its hybrid lineup, positioning it as a "bridge" for hesitant EV buyers. Toyota hybrids accounted for 25% of total sales in 2024, a strategy that’s expected to grow into 2025. (Automotive News)

2. Leasing as a Key Strategy for Retention

Leasing is emerging as a core strategy for automakers looking to retain customers and maintain profitability, especially as rising interest rates push consumers away from traditional financing.

Luxury Leasing Growth

Luxury automakers like Tesla, Audi, and Lexus are leveraging aggressive lease incentives to attract high-end buyers. Tesla, for instance, introduced a $349/month lease deal for its Model 3, effectively driving demand while maintaining brand exclusivity.

Lease-end loyalty programs have proven successful. BMW's retention rate exceeded 75% in 2024, driven by seamless lease transitions and EV upgrades. (J.D. Power)

Mainstream Market Shifts

Manufacturers like Hyundai and Ford are tailoring leasing programs to meet budget-conscious consumers. Hyundai’s $239/month lease for the Tucson became one of the most popular deals of 2024.

However, leasing’s resurgence raises questions for dealerships. Will these incentives cannibalize the profitable sale of pre-owned vehicles?

3. Economic and Policy Influences: Tariffs and Inflation

The economic environment will remain a significant wildcard in 2025.

Tariffs on Imports

Proposed tariffs on vehicles and parts from Mexico, Canada, and China are expected to raise manufacturing costs significantly. Automakers like Toyota and Stellantis, which rely heavily on cross-border production, could face 5-10% price increases per vehicle, pressuring margins. (Wall Street Journal)

Consumer Response to Inflation

Rising interest rates are reshaping consumer behavior. The average new car loan rate of 9.6% is pushing buyers toward shorter loans or cheaper models. Meanwhile, high borrowing costs are also driving many consumers into certified pre-owned (CPO) programs, which saw a 12% sales increase in 2024. (Cox Automotive)

4. Dealership Adaptation: Fighting for Relevance

As direct-to-consumer (DTC) sales models gain traction, dealerships are exploring new ways to remain competitive.

Enhanced Customer Experience

Leading dealership groups are investing in technology-driven retail experiences, such as virtual test drives and online financing tools. The goal? Meet customers where they are—on their phones and laptops.

Service subscriptions are another emerging trend. For instance, some dealerships are bundling maintenance packages and software upgrades to compete with automaker subscription models.

Partnerships and Collaborations

Forward-thinking dealerships are partnering with local businesses to create community-focused sales strategies, positioning themselves as more than just transaction points. These efforts are helping rebuild trust and loyalty in the face of increased competition.

5. The Future of Inventory Management

Manufacturers are treading carefully to avoid the pitfalls of overproduction seen in 2024.

Data-Driven Decisions

Automakers are using predictive analytics to fine-tune production schedules. This approach helps avoid excess inventory while responding quickly to shifts in demand.

Nissan, for example, reduced its planned 2025 production by 10%, focusing on high-demand models like the Rogue and the Altima. (Reuters)

Strategic EV Allocation

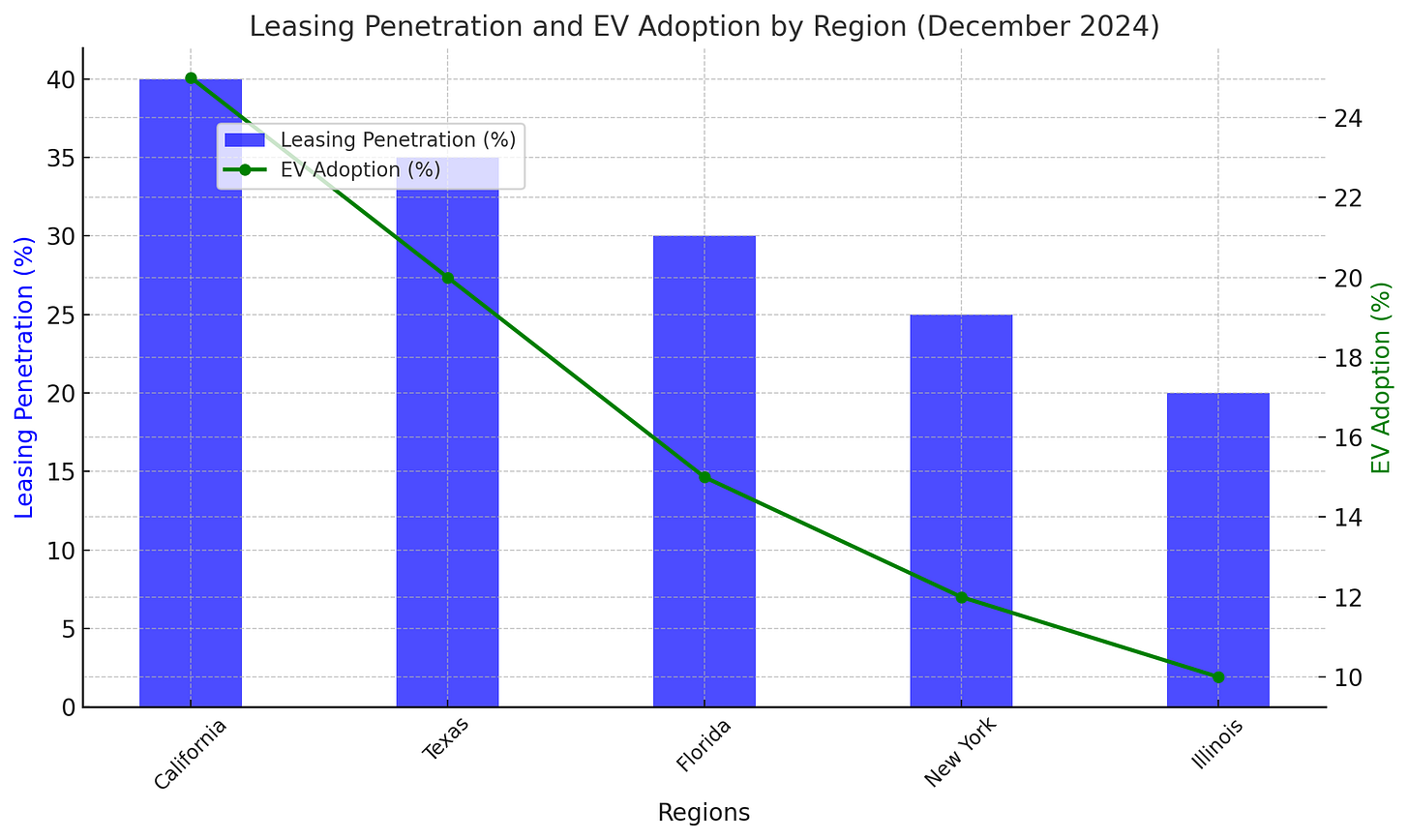

Brands like Ford are prioritizing EV allocations in high-adoption states like California and New York, while pulling back in regions with lower EV demand.

Key Takeaways for 2025

As the industry evolves, certain strategies will define the winners and losers of the next phase:

Leasing Expansion: Leasing will dominate as a consumer-friendly financing option, especially for luxury and EV segments.

Dealer Innovation: Dealerships must innovate to compete with DTC models, focusing on service and digital convenience.

Inventory Precision: Smarter inventory management will prevent the costly oversupply issues seen in 2024, especially in the EV market.

Policy Adaptation: Automakers must prepare for the potential fallout of new tariffs and economic shifts, which could heavily impact pricing strategies.

Looking Ahead

2025 promises to be a transformative year for the U.S. automotive market. As automakers embrace technology and adapt to consumer expectations, the balance between profitability and innovation will be critical. Whether it’s the rise of leasing, the evolution of EV strategies, or the economic pressures of tariffs and interest rates, one thing is clear: the road ahead is both challenging and full of opportunity.

By staying nimble and customer-focused, industry leaders can navigate this pivotal moment and set the stage for long-term success.