Current State of the Automotive Market for December 2024

Sales and Inventory: Signs of Stabilization

Current State of the Automotive Market for December 2024

The U.S. automotive industry is wrapping up 2024 with a mix of resilience and challenges. As we head into the new year, shifting consumer behaviors, evolving manufacturer strategies, and macroeconomic influences are redefining the market. Here’s a comprehensive look at the state of the automotive industry, including sales, inventory, EV trends, and broader economic impacts.

Sales and Inventory: Signs of Stabilization

Sales Trends

November 2024 saw U.S. new vehicle sales rise by 6.7% year-over-year, with a SAAR (Seasonally Adjusted Annualized Rate) of 15.9 million units, matching the strong performance seen in October.

Holiday promotions, including Black Friday sales, played a significant role in driving sales as automakers aimed to clear 2024 inventory ahead of the new model year. (J.D. Power)

Inventory Levels

Inventory levels rose to 3.23 million units, marking the third consecutive month of increases. This brings stock closer to pre-pandemic norms and provides consumers with more choices, which is likely to temper price increases. (Yahoo Finance)

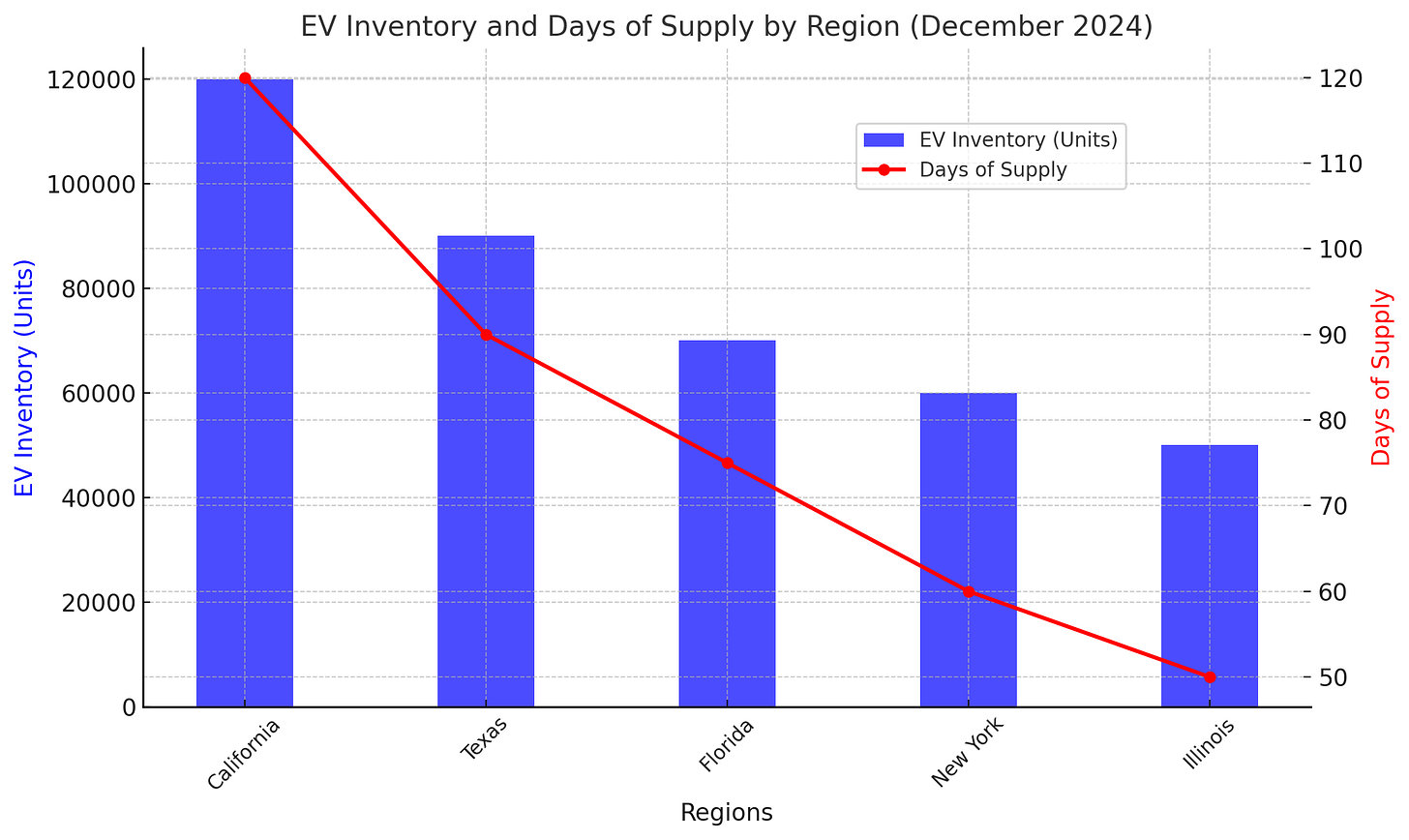

However, elevated inventory in the EV segment signals a growing disparity between supply and demand.

EV Market: Growth and Challenges

Oversupply and Affordability Issues

EV sales growth slowed, contributing to an inventory buildup of 114 days’ supply as of November. This marks a significant increase from 53 days in 2022. (Kroll)

The average EV price has declined to approximately $51,000, down from $66,000 last year. However, affordability remains a barrier for many consumers.

Policy Impacts

Proposed federal changes, such as the potential elimination of the $7,500 EV tax credit, could further impact EV affordability and adoption. Manufacturers often pass these credits to consumers through leasing programs, and losing them would likely shift the cost burden. (Financial Times)

Consumer Hesitation

While EV adoption continues to grow, concerns about charging infrastructure, battery replacement costs, and resale values are slowing momentum. This hesitation is particularly evident among first-time EV buyers.

Manufacturer Strategies: Navigating Headwinds

Nissan

In a bold restructuring move, Nissan announced plans to shutter standalone Infiniti dealerships in the U.S. and merge them into existing Nissan locations. This comes as Infiniti’s sales have declined sharply over the last five years. (New York Post)

Stellantis

Stellantis downgraded its full-year earnings forecast due to falling demand and high U.S. inventories. The company’s focus on streamlining operations and reducing excess stock underscores the difficulties faced by global automakers. (Wall Street Journal)

Tesla

Tesla continued its aggressive pricing strategy, offering significant discounts on popular models like the Model 3 and Model Y to boost sales. These moves have sparked price wars in the EV market but also raised concerns about long-term profitability.

Economic Influences: Tariffs and Inflation

Proposed Tariffs

President-elect Donald Trump’s proposed tariffs on imports from Canada, Mexico, and China could increase vehicle costs and disrupt supply chains. Automakers with extensive overseas production may need to adjust pricing or shift operations to offset additional costs. (Reuters)

U.S. businesses have expressed concerns about these tariffs, estimating an average additional cost of $1,180 per household.

Consumer Behavior

Rising interest rates (9.6% for new car loans and 13.5% for used vehicles) have made affordability a top concern for consumers, driving many toward leasing or certified pre-owned vehicles.

The Used Vehicle Market: Stabilizing Prices

Pricing Trends

Used car prices are showing signs of stabilization, with the average listing price at $25,571. This decline follows periods of extreme volatility during the pandemic and supply chain crises.

Pre-owned EV prices continue to drop, reflecting oversupply and lingering consumer concerns about long-term value. (CarEdge)

Market Dynamics

Increased new car inventory and incentives are pulling buyers away from used vehicles, contributing to price adjustments in the pre-owned market.

Key Lessons and Looking Ahead

As 2024 concludes, the U.S. automotive market is balancing optimism with caution:

Inventory Recalibration: Rising stock levels signal a return to stability, but manufacturers must avoid overproduction, particularly in the EV segment.

Consumer-Centric Strategies: Addressing affordability concerns through incentives, flexible financing, and competitive pricing will be critical.

Policy Preparedness: Automakers and dealerships need to prepare for potential economic and regulatory shifts, including tariffs and changes to EV tax credits.

The automotive market’s resilience lies in its ability to adapt, and as 2025 approaches, industry stakeholders will need to align strategies with evolving consumer demands and economic realities. The key to success will be navigating these challenges while seizing opportunities in innovation and growth.